Prime cost is one of the most fundamental numbers a restaurant operator needs to successfully run his/her restaurant.

Sadly, after working with many pho restaurant owners, my observation is that prime cost is rarely on a restaurant operator's mind. No not in a low priority, but never in his/her mind.

It seems not many restaurant owners are aware of (or maybe even care about) their restaurant's prime cost and why it matters. Prime cost consideration is missing in many projects' planning stage, and most unfortunately it's totally missing during a restaurant's operation.

It seems not many restaurant owners are aware of (or maybe even care about) their restaurant's prime cost and why it matters. Prime cost consideration is missing in many projects' planning stage, and most unfortunately it's totally missing during a restaurant's operation.

So what is Prime Cost, and why does it matter? In this post I'd like to discuss the all-important restaurant Prime Cost.

First, a quick disclaimer: This post is not intended to provide tax, legal or accounting advice. It has been written for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors for all things related to your business' operation.

What Is Prime Cost Of A Pho Restaurant?

Simply put: A restaurant's prime cost is the sum of all its food costs and labor costs.

Here's the formula:

Prime Cost = Food Cost + Beverage Cost + Salaries & Wages + Payroll Tax & Benefits

Pretty straightforward, right?

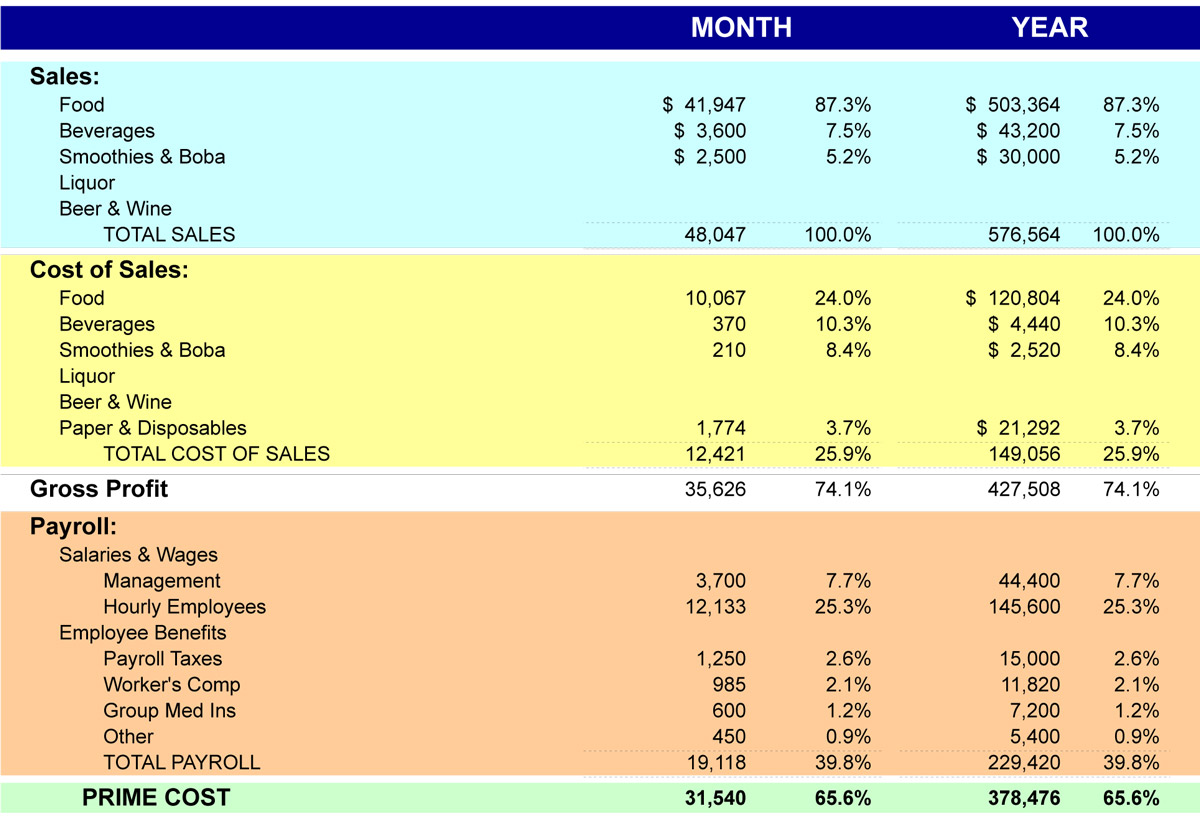

On a restaurant P&L (Profit and Loss) statement, portion of which is shown below, Sales, Cost of Sales (oftentimes called Cost of Goods Sold-COGS) and Payroll costs are rolled up to the Prime Cost. The unfortunate fact is not many owners/operators actually see what their Prime Cost is because they don't get the correct format from their accountant, or they don't know to ask for it.

I can't stress it enough: The way the line items are reported on your P&L is very important. Many "standard" accounting P&L formats provided by general accountants and bookkeepers do not follow this format. So this becomes the first problem an owner/operator faces.

Where Do You Get Your Prime Cost Data From?

The first thing to do is to go get the raw data that allow you to calculate Prime Cost. Look at each line item in the P&L contributing to the Prime Cost calculation. They should serve as a guide to get data from within your operation. It should be pointed out that Prime Cost is always associated with a period of time; a week, month, quarter, year, etc.

A. Sales

This one is obvious and easy. If you're using a modern POS (point of sale) system to take payments in your brick-and-mortar location, then you already have the biggest piece of data collected. Additionally, your sales maybe coming from online sources such as from your website, mobile apps, or various other online ordering and delivery services. At minimum, I'd recommend separating food, beverages, smoothies/boba drinks, then liquor and beer & wine, as appropriate, into their own categories as shown in the table. And that's your SALES section.

Note: It's important to select online, delivery and mobile app services that can integrate well with your POS and accounting system. This is a requirement, it's what your business must have. Don't just settle on something cheap, easy but doesn't meet this important business requirement. You'll be tearing your hair out later because all your systems speak different languages with no (easy) way to cross communicate, integrate and share the numbers. The net result of this poor decision is you don't have the right numbers when you need them and can't run your business as you need to. Many owners end up not knowing their numbers and just mange by the seat of their pants, and this is one of the reasons. So don't fall into this trap.

B. Cost of Sales

This one requires you to have a good inventory system (IS) in place as a prerequisite, with the right process and tools in place to track the numbers. Having good inventory tracking means you have good data on each of your COGS category at your fingertips. I don't know a good restaurant with accurate cost of sales numbers not having an effective inventory system. Implementing an effective IS can be tough for many who are not familiar with and/or never run a good system before. But really, it's just a matter of making it a priority, because you can learn anything if it's important to you. Regardless, a restaurant should (must) have a solid inventory system embedded in the operation regardless of whether they track their Prime Cost.

Note: In any restaurant operation, nothing works in a vacuum. Everything is tied to everything else. The Prime Cost calculation is a perfect example of how sales, POS system, inventory system, management, staffing and numerous other operational factors all come together to enable success or cause failure for your restaurant. Investors look at Prime Cost as one of the many indicators of how a restaurant is performing before deciding to invest. Sadly, many owners think they should have a POS but inventory is not necessary, or just pick a delivery service that everyone seems to be using without considering the integration factor. This is not wise decision making, and as a result their Cost of Sales becomes elusive.

C. Payroll

This one is also straightforward. You want to include all payroll (salaries and hourly wages) and associated employee benefits for the period in question. Without these elements you will not get a complete picture of your payroll or staffing cost. If you have employee meal, contests, awards or similar programs, then they should also be tracked and reported in this section because they are also the restaurant's employee-related costs.

Note: Many restaurant operators run their business on a cash basis without proper accounting, thinking this saves them money. While this may be true in their minds, truth is there are way more potential negative side effects than meets the eye. To put it bluntly, it really is cheating, breaking the law, mistreating and taking advantage of your employees, and is basically a bad way to run a business. Aside from the possible tax and legal consequences, such operators will never be able to calculate Prime Cost and utilize it to increase profitability.

Ways To Use Prime Cost To A Pho Restaurant's Benefits

As a key performance indicator (KPI), Prime Cost gives you an immediate snapshot of your operation's performance, and whether there are areas that need urgent attention to bring the numbers back to where they should be.

Looking at the formula above, elements such as sales and payroll should be readily available from your POS and payroll systems pretty much at any time. With respect to inventory, it should be done at least 2 times a week or even more frequently so you also have fresh food cost data all the time. Once you have access to consistently fresh data, it's time to use it to run your business.

For most fine dining or sit-down/table service concepts, Prime Cost can run 60-65% or even higher. For fast-casual, quick serve concepts, Prime Cost should not exceed 55%, though I always shoot for 50% or even lower. So the Prime Cost formula tells us that, in order to lower Prime Cost, you can do any combination of the following things:

- Decrease food cost,

- Decrease beverage cost,

- Decrease salaries and wages,

- Decrease payroll tax & benefits

Realizing that not all line items are created equal, the trick is to prioritize your tweaks so that you solve the biggest issue with the highest potential positive impact or payback first. Without specific real case numbers for this exercise, I would generally (but fairly accurately) reason that decreasing 1) food cost and 3) salaries/wages would give me the highest initial payback/benefits. This of course assumes that beverage sales is not a big revenue contributor.

Take food cost:

- What is my food cost percentage and how do I reduce it without compromising food quality. Regardless of whether it's 35% or 12%, the question is why is it that high (35%) or that low (12%).

- If it's on the high side then what are the reasons for it. Is it because the recipes actually call for such high quantity usage, or maybe it's employee carelessness/incorrect trimming and cutting of ingredients during prep, or maybe due to other waste or shrinkage reasons, high supplier cost or high product reject rates without proper credits, no proper FIFO (first-in, first-out) practice resulting in high spoilage and discard rates, overstocking or even under stocking of inventory, maintaining stock for a menu item that does not sell well, etc. Each of these areas can be improved to lower food cost. The opportunity to find and fix potential issues is really endless.

- If it's on the low side then what are the real reasons for it. Having low food cost may be great but also may not necessarily be a good thing. Is it because you often have to 86 a menu item due to unavailable stocks forcing customers to choose a more available item, or maybe your ingredient quality is just enough to make your dishes "edible" but it's really not great. The point is, you have to look at food cost in conjunction with sales/revenue, and super low food cost sometimes means low sales also. Therefore the real opportunity may be in bringing in higher quality ingredient selection (thereby raising food cost a bit) in order to vastly improve sales number. The net result maybe that as you bring food cost in line with industry standard, you actually increase your sales numbers too. There may be nothing to actually improve here, but at least a flag has been raised.

Take salaries and wages:

- This area is all about efficiency of kitchen production. Salary and wage costs are direct reflection of the amount of time it takes to do certain tasks as part of the production. While food costing is all about the tangible, physical things or objects you can touch, feel and manipulate, production efficiency (labor cost) is all about the process, action and movement of a person performing the required tasks. As a result, in order to improve salary and wage cost numbers, you're actually looking for ways to improve processes.

- Process improvement can take on many levels with endless tweaks, and as mentioned before the best approach is to prioritize the changes that give you the highest benefits first. From my experience, some of the best payback include better training, improved both efficiency and proficiency, more effective hiring and onboarding process, and last but not least, a good employees pay package.

- Very important: reducing or minimizing payroll costs doesn't always mean paying people less or keeping your pay low. For solidly run restaurants, it should mean giving employees the right training and tools to be more productive, make less mistakes, and have more pride in what they do. It should also mean allowing high performing employees to grow while also replacing low or non-performing ones. In all cases, having higher pay means you can attract and retain higher performing and more loyal employees as well; I'd rather have one of these high performing professionals than 2 or 3 employees who don't care. So again, the opportunity for control/decrease salary and wage costs lies in solving the staffing problems the right way, and not always following the easy and obvious paths.

So there it is. You'll probably never look at restaurant Prime Cost the same again. These are just a few things to help illustrate what Prime Cost is and how a pho restaurant can take advantage of it through knowledge and application. Build this into your operation, make Prime Cost analysis a part of your daily/weekly to-do habits, and reap the benefits that the big guys are already doing day in day out.

Learned a lot from this post Cuong. Do you have some tips on how best to find (maybe questions to ask or things to look out for) a reliable accountant familiar with restaurant business?

Many thanks!

@vungtaukid6092: A good business (restaurant included) should always have 3 consultants as part of their team: a business/restaurant consultant, an attorney, and an accountant. It doesn't need to cost that much to retain these professionals, but when you need them, they're there to make sure you're always on the right track.

The obvious things you'd want to know upfront from an accountant would be:

- Has the accountant worked with restaurants before, and if so what type of restaurant (you don't necessarily want to know specific restaurants as that may be confidential info). This information tells you if they can handle or at least are familiar with complex restaurant operation and requirements. Not that you want the accountant to become your employee. The end goal here is to get financial reports (P&L, etc.) in the right format that will allow you to use it to run your business.

- If the accountant has not worked with restaurants before then it still may not a deal breaker. What you're looking for is an accountant who is open to learning new industry, and can apply his/her knowledge there. You want someone who can actively work with you to give you advice, data/information to help you run your business. There are "lazy" accountants who only want to follow templates and insist that they do the same things they always do. There are others who just do accounting without really understanding the numbers, what they mean to the operation, and how to improve them. Stay away from these people.

- Last but not least, also may be most important, you need to know exactly what you want, and what you want the accountant to do for you. You won't find the right help if you don't know what you're looking for and what you want the help to do for you.

Hope these help to start. Ask me more questions if you have them.

I think not many Vietnamese owners know or even care about this Prime Cost. It's not how Vietnamese run business.

@DuyDT6: I agree with your first sentence, but not so much with your second.

Fact is, many restaurant owners, not just Vietnamese restaurant owners, do not have a good understanding to Prime Cost, and therefore do not understand what it can do for them. It's like many other factors in the restaurant business, you may get by without doing the right thing, but if you take a real effort to do something right, then you'll do a lot better, have less trouble, have more direction, be more efficient, need less guesswork, etc. So it's not about imitating what everybody else is doing (which is what Viet people are very good at doing) but it's more about doing business the right way to assure success in a new location.

On a personal level, a restaurant owner makes up his/her own mind. And to properly run a sustainable restaurant business, Prime Cost should be a major part of the MO (mode of operation) at least in North America.

On the second point: A successful business is defined by the inherent location it is operating in. Among the determining factors of success are tax, legal, accounting, labor considerations on top of the normal marketplace, food cost, recipes, menu, staffing considerations. It has nothing to do with being Vietnamese or not, and everything to do with where/what locality you run your business in. Reasonable people would surely not run (or more accurately, cannot run) a restaurant the same way in North America as he/she does in Vietnam.